montana sales tax rate 2020

The state sales tax rate in Montana is 0000. Montana Individual Income Tax Resources.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The current total local sales tax rate in Butte MT is 0000.

Montana tax rate is unchanged from last year however the income tax brackets. The December 2020 total local sales tax rate was also 0000. State.

There are additional taxes. ARM 4214101 through ARM 4214112 and a 4 Lodging Sales Tax see 15- 68-101 MCA through 15-68-820 MCA for a combined 8 Lodging Facility Sales and Use Tax. Both these taxes are collected by the facility from the user and remitted to the Department of Revenue.

The December 2020 total local sales tax rate was also 0000. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Montana state income tax rate table for the 2019 - 2020 filing season has seven income tax brackets with MT tax rates of 1 2 3 4 5 6 and 69 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

This is the total of state county and city sales tax rates. Although the lowest rate rises to 47 percent up from 10 percent conforming to the federal standard deduction 12400 last year compared to Montanas current standard deduction of 4790 yields tax savings for low-income taxpayers as well. The top tax rate of 69 is the 13th highest in the nation but Montana is one of only six states that allows Federal taxes to be deducted on the state return.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The minimum combined 2022 sales tax rate for Billings Montana is 0. Montanas tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Exact tax amount may vary for different items. These two taxes are a 4 Lodging Facility Use Tax see 15-65-101 MCA through 15-65-131 MCA.

Interactive Tax Map Unlimited Use. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. 2019-2020 MONTANA AGRICULTURAL LAND CLASSIFICATION AND VALUATION MANUAL January 1 2019-December 31 2020 STATE OF MONTANA Steve Bullock Governor MONTANA DEPARTMENT OF REVENUE Gene Walborn Director COMPILED BY PROPERTY ASSESSMENT DIVISION Shauna Helfert Administrator SAM W.

We encourage all Montanans to file early and electronically. Montana has no state sales tax and allows local governments to collect a. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

Montana Individual Income Tax Resources. The December 2020 total local sales tax rate was also 0000. As of July 1 2020.

The Montana sales tax rate is currently 0. Local Tax Rate Combined Rate Rank Max Local Tax Rate. MITCHELL BUILDING 125 N.

Montanas income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2004. Table 4Top Tax Rates on Ordinary Income California Colorado Idaho Montana Nevada North Dakota Oregon South Dakota Utah Washington. 2020 Montana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

775 for vehicle over 50000. Montana has seven marginal tax brackets ranging from 1 the lowest Montana tax bracket to 69 the highest Montana tax. Only a few counties enforce a local state tax which is why Montanas average combined.

Ad Lookup Sales Tax Rates For Free. The County sales tax rate is 0. The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data.

Montana has a modestly progressive personal income tax. Did South Dakota v. Montana Income Tax Rate 2019 - 2020.

Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax. 2022 Montana state sales tax.

The current total local sales tax rate in Yellowstone County MT is 0000. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis.

The Billings sales tax rate is 0. State State Tax Rate Rank Avg. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher.

States With Highest And Lowest Sales Tax Rates

U S Sales Taxes By State 2020 U S Tax Vatglobal

Pdf Sales Taxes And The Decision To Purchase Online

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States Without Sales Tax Article

Which States Have No Sales Tax Quora

U S States With No Sales Tax Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Ebay Sales Tax A Complete Guide For Sellers Taxhack Accounting

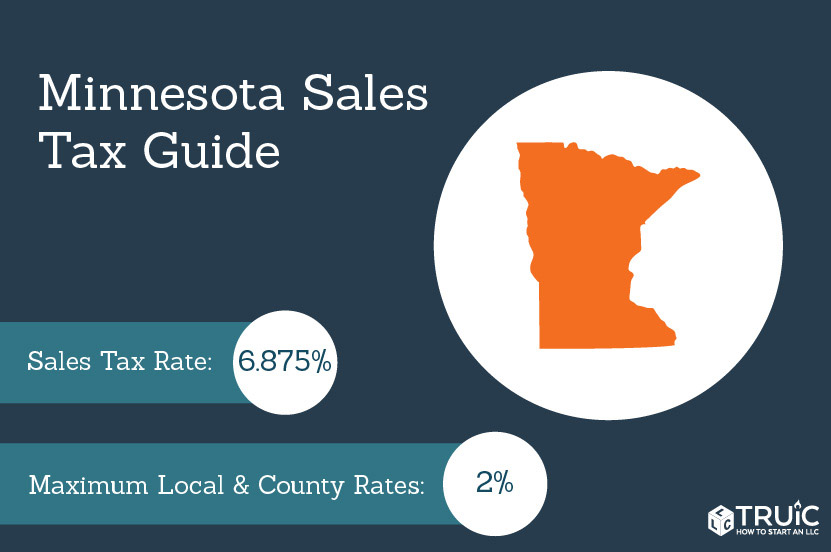

Minnesota Sales Tax Small Business Guide Truic

What Is The Broward County Sales Tax The Base Rate In Florida Is 6

Montana Tax Information Bozeman Real Estate Report

Sales Tax By State Is Saas Taxable Taxjar

Sales Taxes In The United States Wikiwand

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation